puerto rico tax incentives 2020

Of particular interest are Chapter 2 of Act 60 for Resident Individual Investors and Chapter 3 for Export Services which shield new residents who live in Puerto Rico for at least half the year from paying. Since 2012 Puerto Rico offers various tax incentives for both individuals and businesses.

The Puerto Rican government is luring businesses and investors to their beautiful island with attractive tax incentives like a 4 corporate tax rate and a 0 tax rate on capital gains.

. Puerto Rico Tech Talk 2020 by Invest Puerto Rico 16072022 Link Publicitário Acesse. More importantly the requirements for each program have been adjusted. To promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify processes optimize and provide greater transparency Act 60-2019 was signed which establishes the new Puerto Rico Incentive Code.

In June 2019 Puerto Rico made substantial changes to its tax incentives that came into effect on January 1 2020. Puerto Rico - Green Energy Fund. You should use common sense and rely on your own legal counsel for a formal legal opinion on Puerto Ricos tax incentives maintaining bona fide residence in Puerto Rico and any other issues related to taxes or residency in Puerto Rico.

This page is dedicated to setting up a successful export business in Puerto Rico. The 2008 Economic Incentives for the Development of Puerto Rico Act EIA provides a wide array of tax credits and incentives that enable local and foreign companies dedicated to certain business activities to operate within Puerto Rico. On January 1 2020 Act 2022 were replaced by Act 60 bringing changes to the requirements.

Puerto Rico Tax Incentives Redwood City California. Ad We file Puerto Rican Hacienda US and Canadian returns. You should use common sense and rely on your own legal counsel for a formal legal opinion on Puerto Ricos tax incentives maintaining bona fide residence in Puerto Rico and any other issues related to taxes or residency in Puerto Rico.

Thursday July 30 2020 - 1200. As of 2020 Puerto Rico actually consolidated all of these tax acts into one Act 60 of the Incentives Code. 20 likes 1 talking about this.

For taxable year 2020 any holder of a tax incentives grant under Act No. On July 1 2019 Puerto Rico enacted legislation providing tax incentives for US. You should use common sense and rely on your own legal counsel for a formal legal opinion on Puerto Ricos tax incentives maintaining bona fide residence in Puerto Rico and any.

This resulted in some adjustments to the qualification requirements among other changes. Autor do post Por Relocate Puerto Rico. 60-2019 previous incentives laws or any special incentive law in Puerto Rico will be deemed to have complied with the following requirements contained in said grant as long as any failure to comply is directly related to the emergency caused by COVID-19.

Learn what the new requirements are and how they will affect you. Read more about Puerto Rico - Green. Puerto Rico Tax Incentives Updated August 2020 Act 60 Replaces Act 20.

Data de publicação 26072022. The indictment describes an IRS sting operation wherein an undercover. Contact us today and we can help you make a decision of moving your business or a portion of it to Puerto Rico and pay 4 on export of services increasing your return on investment.

An indictment filed October 14 2020 alleges that a senior tax partner Defendant of a large public accounting firm in Puerto Rico along with others known and unknowndevised and intended to devise a scheme and artifice to defraud the Internal Revenue Service. The updated requirements are mentioned in this article but for ease we have kept the original names Act 20 and Act 22 when discussing these. Many sizable tax breaks like these are offered across a variety of industries making Puerto Rico Americas last true tax haven.

Under this new law known as the Incentives Code Acts 20 and 22 have been consolidated into Act 60 and were subsequently renamed. 2020 by Trusts Taxes LLC. Puerto Rico Earns Opportunity Zone Designation Read More May 31 2018.

Citizens that become residents of Puerto Rico.

Could Moving To Puerto Rico Reduce Your Taxes Expensivity

Petition Eliminate Puerto Rico S Act 60 20 22 Change Org

Arrested Development Puerto Rico In An American Century The Journal Of Economic History Cambridge Core

Could Moving To Puerto Rico Reduce Your Taxes Expensivity

A Global Americans Review Of Boom And Bust In Puerto Rico How Politics Destroyed An Economic Miracle

Will D C And Puerto Rico Be Granted Statehood Steve Forbes What S Ahead Forbes Youtube

Puerto Rican Government Debt Crisis Wikiwand

Relocate Puerto Rico Puerto Rico Tax Incentives Act 20 Act 22 Residency Facebook By Relocate Puerto Rico Quickly Learn If The Two Most Popular Tax Incentives In

A Tax Haven Called Puerto Rico Eyes On The Ties

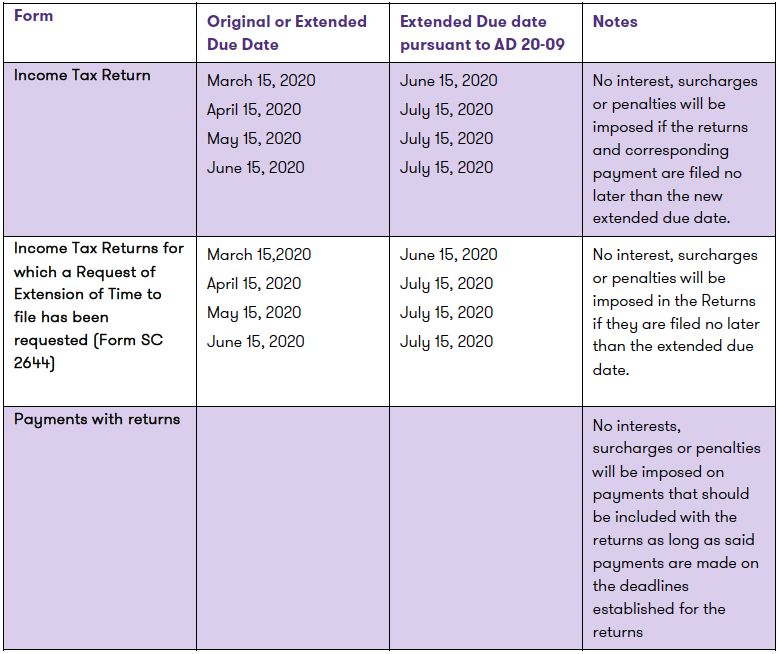

New Deadlines Established By The Puerto Rico Treasury Department Pursuant To Ad 20 09 Grant Thornton

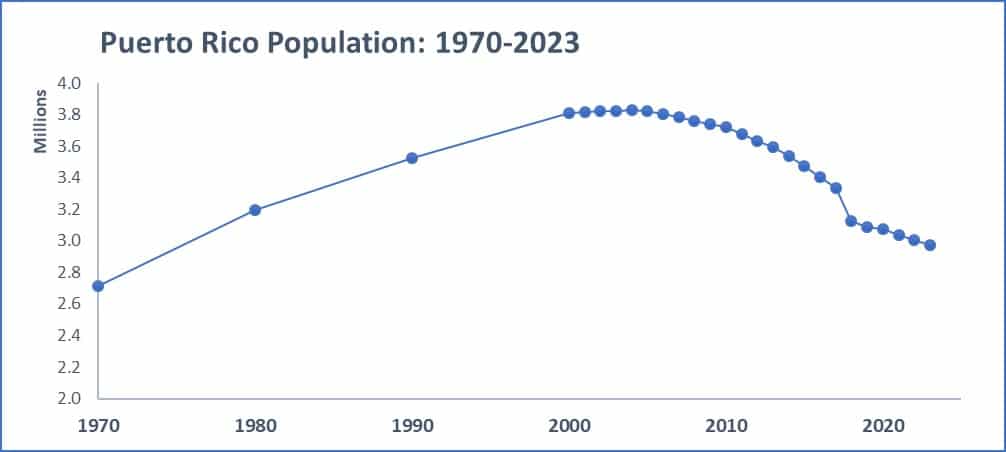

As It Recovers Puerto Rico Needs More People And More Economic Freedom Reason Foundation

Puerto Rican Government Debt Crisis Wikiwand

Puerto Rican Government Debt Crisis Wikiwand

Could Moving To Puerto Rico Reduce Your Taxes Expensivity

Sm Best Places Pr Report Puerto Rico Person Guide

Puerto Rico To Hold Statehood Referendum Amid Disillusion News Telesur English